GOALS BASED INVESTING

Nowadays what passes for investment advice is a lot of “one-size-fits-all” investment ideas. Where the same basket of assets is used to fund different financial goals with different investment time frames and different drawdown amounts.

Your Private Wealth Adviser will help tailor the right investment framework that considers your each goal and brings it to the forefront of the advice process. Our objective is to deliver you to your goals whilst taking the least risk possible.

OR CALL 02 9888 4764

What is goals based investing and how is it different?

Under the traditional approach advisers will perform some method of risk profiling when providing advice to you in relation to your investments. It most likely will involve some sort or weighted questionnaire that will determine how much risk you are able to tolerate and produce a risk profile like defensive, balanced or growth.

The problem with this method is that it has little to do with fulfilling your financial goals or objectives, which is the reason most people seek advice in the first place.

With goals based investing your financial objectives are brought to the forefront of the advice process. This is not to say that we do not consider your tolerance to risk but more importantly your investments are tailored in order to reach a targeted return or specific outcome in order to fulfil the financial costs for these goals within a required time frame.

Your goals can then be broken down to three broad categories:

Essential Needs – living expenses such as food, clothing and shelter.

Lifestyle – holidays, new cars, upgrading the home.

Legacy – endowments, leaving something behind for grandchildren.

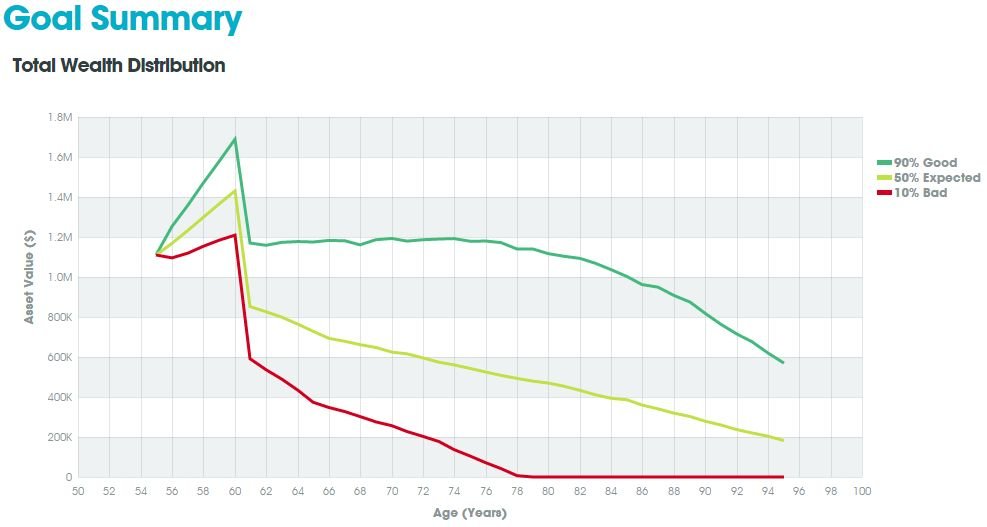

Some of these goals may have different priorities and investment timeframes so it makes sense to address these objectives individually. How we do this is by putting together various financial models that show your current position, the risks and trade offs of different scenarios and market conditions. This enables you to better understand your risks and investment choices.

By using a goals based approach the focus is more on the outcomes of the strategy and how likely you are to achieve those goals.